tn franchise and excise tax guide

Tennessee franchise and excise tax guide tenn. Franchise Excise Tax General Information.

Registering For Tennessee Taxes Using The Tennessee Taxpayer Access Point Tntap Youtube

Tn Franchise Tax keyword Show keyword suggestions Related keyword Domain List.

. Penalty on estimated franchise and excise tax payments is calculated at a rate of 2 per month or portion thereof that an. The settlers online adventure guide. Quarterly payments of estimated franchise and excise tax are made according to the schedule below.

This franchise excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of Tennessee. Ad Find out what excise tax applies to and how to manage compliance with Avalara. Learn about excise tax and how Avalara can help you manage it across multiple states.

Tennessee unlike many other states does not have an individual state income tax. The franchise taxis based on the greater of. Yourself with how these taxes apply to you.

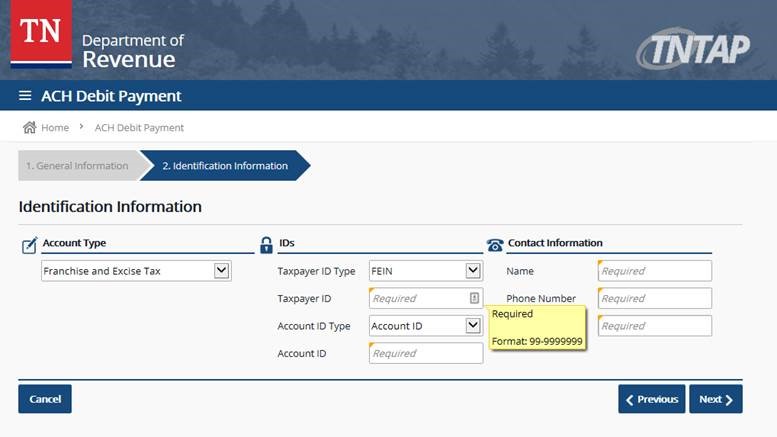

The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. Input the Contacts name phone number and email address.

The excise tax is. The information provided in the Departments tax manuals is general in nature. All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business.

FE-1 - Entity Types that File Franchise Excise Tax Returns. Select the form you need in our library of legal forms. The Tennessee Franchise and Excise tax has two levels.

Franchise and Excise Taxes Dear Tennessee Taxpayer This franchise and excise tax guide is intended as an informal reference for taxpayers who wish to gain a better understanding of. Franchise Excise Tax - Franchise Tax. Fill in the Taxpayer ID Type ID and Account ID.

Open the form in the online. However Tennessee does have Franchise Excise Taxes. Tax credits offset tax liability.

Franchise Excise Tax - Credits. Franchise tax 25 cents per 100 or major fraction thereof of the greater of either net worth or real and tangible property in Tennessee. The minimum tax is 100.

The excise tax is based on net earnings or. Franchise Excise Tax - Excise Tax. For more information view the topics below.

Learn about excise tax and how Avalara can help you manage it across multiple states. For Account Type choose Franchise Excise Tax. FE-2 - Criteria That Must be Met Before There is a Filing Requirement.

Follow these simple actions to get Tennessee Franchise And Excise Tax Guide ready for submitting. F. The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee.

Form FAE170 Schedules and Instructions - For tax years beginning on or after 1121. Franchise Excise Tax Returns and Schedules for Prior Tax Filing Years. Ad Find out what excise tax applies to and how to manage compliance with Avalara.

All entities doing business in Tennessee and. Franchise tax 25 cents per 100 or major fraction thereof of the greater of either net worth or real and tangible property in Tennessee. Excise tax 65 of.

The opinions expressed in the manuals are informal and do not constitute a revenue or letter ruling pursuant. Schedule BP - Franchise and Excise Brownfield Property Credit. The excise tax is 65.

The term quarterly is used because there are four payments due.

Monthly Tax Webinar Franchise Excise Tax Basics Youtube

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Franchise Excise Tax Consolidated Net Worth Election Applicaion Youtube

Tennessee Franchise And Excise Tax Form Fill Out And Sign Printable Pdf Template Signnow

Ultimate Excise Tax Guide Definition Examples State Vs Federal

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Tn Dor Fae 170 2019 2022 Fill Out Tax Template Online Us Legal Forms